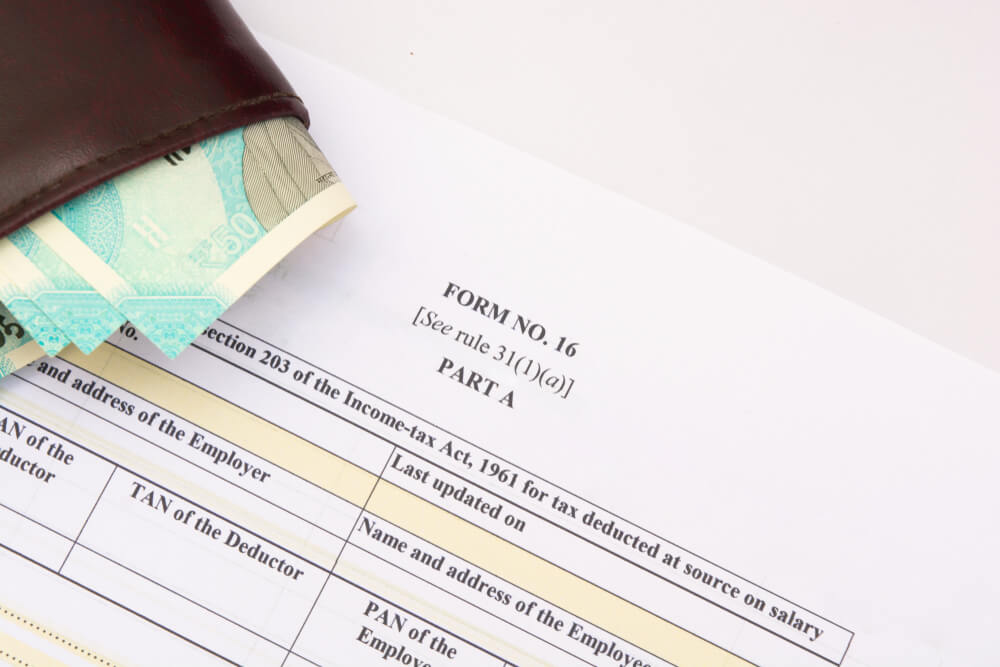

Filing Form 16 can be a daunting task for many. This is where a professional Form 16 filing service comes in handy.

This article explores the benefits of using such a service, focusing on online Form 16 submission and Form 16 eligibility criteria.

Key Benefits

Using a professional Form 16 filing service offers several advantages:

- Accuracy: One of the reasons for professional Form 16 filing services is that they minimize risks of error in the filling process.

- Time-Saving: Saves time as Form 16 is submitted online, hence saving precious time.

- Expertise: Experts will be well conversant with the criteria for Form 16 and shall ensure that all norms are fulfilled.

Why Choose a Professional Service?

Here are some reasons to opt for a professional Form 16 filing service:

- Convenience: Online Form 16 submission can be done from the comfort of your home.

- Compliance: Professionals ensure that all Form 16 eligibility criteria are met, avoiding any legal issues.

- Support: Get assistance with any questions or issues that may arise during the filing process.

Conclusion

In conclusion, using a professional Form 16 filing service offers numerous benefits, including accuracy, time-saving, and compliance with Form 16 eligibility criteria. For a hassle-free experience, consider using Easy Tax Live.

We provide expert services for online Form 16 submission, ensuring your filing process is smooth and efficient.